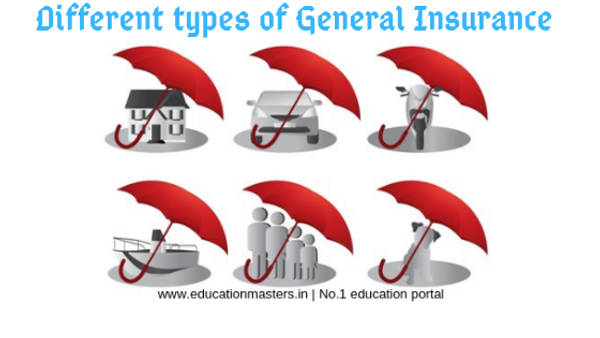

What are the different types of General insurance?

What are the types of General insurance?

Insurance can be broadly isolated in three categories– life, health and general. General policy is protection for resources other than our life and well being. General insurance covers the back up plan against harm, misfortune and burglary of your assets. The premium and front of general protection relies on the sort and degree of protection. A general protection arrangement ordinarily has a time of a couple of years. In India, general insurance approaches are of the accompanying sorts:

Home and family unit protection ensures your home and the things inside it. A home protection approach would likewise cover normal and man-made conditions. The substance that are secured under a home protection strategy would rely upon the kind of arrangement you purchase.

Another well known sort of general protection is travel protection, which covers your outings abroad. Travel protection can be assumed to cover misfortune or burglary of your resources just as records. Some movement protection strategies likewise spread flight deferrals and restorative crises. Travel protection can be taken for individual just as excursions for work.

Protection for the harm or burglary of your engine vehicle, bike, three-wheeler or four-wheeler, is secured under this sort of protection. The harm caused to the vehicle can be caused normal or man-made conditions, the degree of which would change from arrangement to approach. This is one of the main types of general insurance.

Under the Motors Vehicle Act, engine protection is required in India. New engine vehicles accompany an outsider protection directly from the showroom itself.

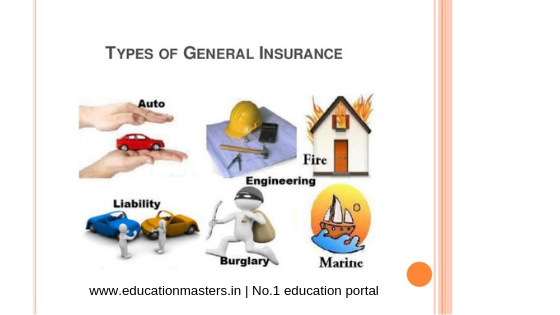

Other popular classifications of general insurance:

Marine protection is essential in light of the fact that through marine protection, send proprietors and transporters can make sure of asserting harms particularly considering the method of transportation utilized. Of the four methods of transport – street, rail, air and water – it is the last most which makes a great deal of stress the transporters not just in light of the fact that there are characteristic events which can possibly hurt the freight and the vessel yet in addition different occurrences and qualities which could cause a gigantic misfortune in the money related coffin of the transporter and the delivery organization

Business insurance is the upcoming type of general insurance that helps protect the businesses from losses in the events of misfortune. For example : Property damage, legal losses or employee related businesses risk. Most business companies evaluate their potential risks based on the company’s work environment.

Rural insurance:

This type of general insurance is taken by the rural population of a country. People living in such regions are provided with working capital and income generating assets. The schemes benefits the policy holders as the premiums are charged at a special subsidized prices.

Yield/Crop insurance:

Similarly crop or yield insurance covers the farmers and other agricultural producers in case of bad weather , unexpected loss or poor yields. Other factors contributing in crop insurance are fire, drought or unintentional flooding.

In conclusion:

Much the same as extra security and medical coverage, even broad protection can be purchased online just as disconnected. The online strategies can be less expensive, so ensure you analyze the different general insurance companies before you settle on a buy choice.

Insurance can be broadly isolated in three categories– life, health and general. General policy is protection for resources other than our life and well being. General insurance covers the back up plan against harm, misfortune and burglary of your assets. The premium and front of general protection relies on the sort and degree of protection. A general protection arrangement ordinarily has a time of a couple of years. In India, general insurance approaches are of the accompanying sorts:

Main types of general insurance:

- Home Protection Insurance

- Travel Insurance

- Car Insurance

- Murine Insurance

- Business Insurance

- Crops Insurance

- Rural Insurance

Home protection insurance:

Home and family unit protection ensures your home and the things inside it. A home protection approach would likewise cover normal and man-made conditions. The substance that are secured under a home protection strategy would rely upon the kind of arrangement you purchase.

Travel insurance:

Another well known sort of general protection is travel protection, which covers your outings abroad. Travel protection can be assumed to cover misfortune or burglary of your resources just as records. Some movement protection strategies likewise spread flight deferrals and restorative crises. Travel protection can be taken for individual just as excursions for work.

Car Insurance:

Protection for the harm or burglary of your engine vehicle, bike, three-wheeler or four-wheeler, is secured under this sort of protection. The harm caused to the vehicle can be caused normal or man-made conditions, the degree of which would change from arrangement to approach. This is one of the main types of general insurance.

Under the Motors Vehicle Act, engine protection is required in India. New engine vehicles accompany an outsider protection directly from the showroom itself.

Other popular classifications of general insurance:

Marine insurance:

Marine protection is essential in light of the fact that through marine protection, send proprietors and transporters can make sure of asserting harms particularly considering the method of transportation utilized. Of the four methods of transport – street, rail, air and water – it is the last most which makes a great deal of stress the transporters not just in light of the fact that there are characteristic events which can possibly hurt the freight and the vessel yet in addition different occurrences and qualities which could cause a gigantic misfortune in the money related coffin of the transporter and the delivery organization

Business insurance:

Business insurance is the upcoming type of general insurance that helps protect the businesses from losses in the events of misfortune. For example : Property damage, legal losses or employee related businesses risk. Most business companies evaluate their potential risks based on the company’s work environment.

Rural insurance:

This type of general insurance is taken by the rural population of a country. People living in such regions are provided with working capital and income generating assets. The schemes benefits the policy holders as the premiums are charged at a special subsidized prices.

Yield/Crop insurance:

Similarly crop or yield insurance covers the farmers and other agricultural producers in case of bad weather , unexpected loss or poor yields. Other factors contributing in crop insurance are fire, drought or unintentional flooding.

In conclusion:

Much the same as extra security and medical coverage, even broad protection can be purchased online just as disconnected. The online strategies can be less expensive, so ensure you analyze the different general insurance companies before you settle on a buy choice.

सरकारी नौकरियों, जीके अपडेट्स और करेंट अफेयर्स की ताज़ा जानकारी सबसे पहले पाने के लिए:

-

हमारे WhatsApp चैनल को फॉलो करें:

https://whatsapp.com/channel/0029Vb6sjZz0wajwDXcd5B0U -

हमारे Telegram चैनल को फॉलो करें:

https://t.me/educationmastersin -

हमारे Facebook Page को फॉलो करें:

https://www.facebook.com/educationmastersindia

.png)

.jpg)

.jpg)